#IRS BUSINESS TRAVEL DOCS WHEN BUYING REAL ESTATE UPGRADE#

While it remained unclear until recently whether Congress would pass the additional funding, the Treasury has spent nearly a year developing plans to upgrade the IRS. Since Biden’s election, Republicans have tried to block the agency from gaining additional resources, warning that the agency would be weaponized by Democrats. The IRS has struggled for years amid budget cuts engineered by Republicans, who have accused the agency of targeting conservative groups. About Us We are a team of driven, high-touch brokers who are known for our extensive market knowledge and unmatched devotion to clients.

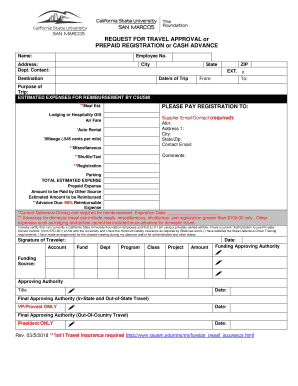

“Instead, they will allow the IRS to work to end the two-tiered tax system, where most Americans pay what they owe, but those at the top of the distribution often do not.” For the second year, taxpayers can use a new and simpler. If a Realtor uses part of their home exclusively and regularly for business, some mortgage, utility, tax and insurance expenses may also be deductible. “These investments will not result in households earning $400,000 per year or less or small businesses seeing an increase in the chances that they are audited relative to historical levels,” Yellen wrote. They can deduct certain car expenses using either the actual expense method or the standard mileage rate of 56 cents per mile for 2014. She also promised that middle-class households would not face more onerous scrutiny and that their audit rates would not rise. The cost of all driving you do for your real estate business, with the important exception of commuting to and from your home. Car Deductions: The single most claimed tax deduction for all small businesses is car and truck expenses. As a business term, real estate also refers to producing, buying, and. and can include land, buildings, air rights above the land, and underground rights below the land. Here are the most common tax deductions taken by real estate pros: 1. Leila Najafi is a luxury travel and lifestyle writer and editor with over five years of experience covering travel rewards programs, destination and buying guides, and more. In her memo, Yellen reiterated that a bolstered IRS would be focused on cracking down on rich tax dodgers and big companies that have long evaded paying what they owe to the federal government. 7031 Koll Center Pkwy, Pleasanton, CA 94566.

0 kommentar(er)

0 kommentar(er)